Transafe Anti Money Laundering Platform

Transafe Anti Money Laundering Platform

Project Details

AML platform connects the Retails Banks and Non Banking Financial Institutes (NBFIs) with Financial Intelligence Centers (FICs) run under economic ministry of a country. Daily transaction reports are collected and analysed in real time to provide predictive AML analysis and transaction history investigation.

Timeline

6 Months

Platform

Web application

Deliverables

Business process consulting; User experience design; Application Development; Deployment and Support

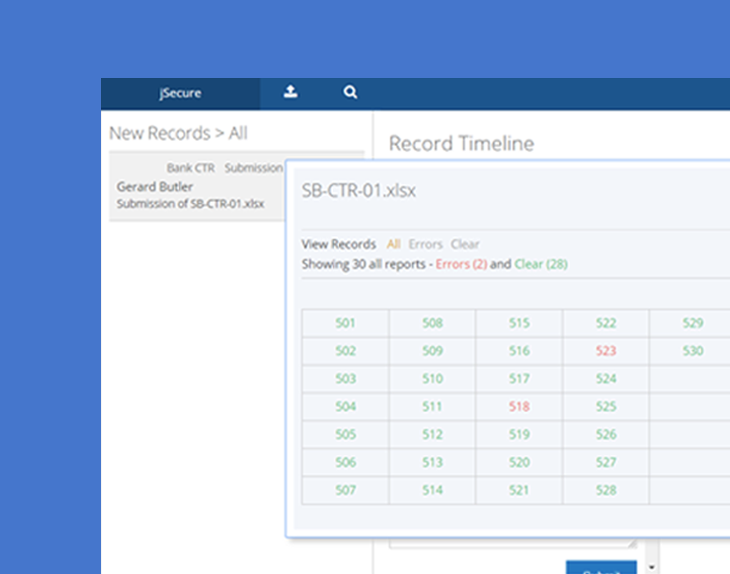

Data Collection

Daily transactional data from banks and NBFIs are collected into the system via Financial Institute portal. User accounts and special workflows are implemented in the system for financial institutes to ensure data accuracy and legal compliance.

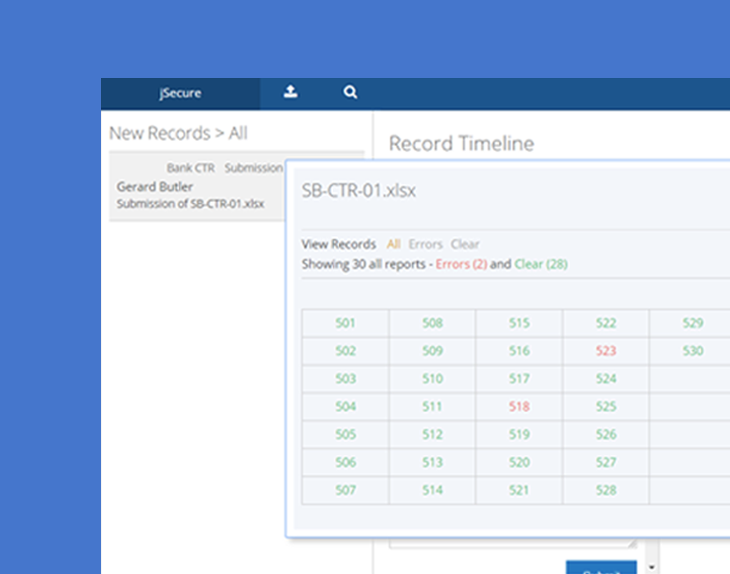

Compliance Validation

Application validates all uploaded transactional data with extensive rules customisable by FIC admins. Validation rules are configurable for specific report types such as Cash Transaction Report (CTRs), Electronic Transaction Report (ETR), Suspicious Transaction Report (STR) etc.

Key Features Developed

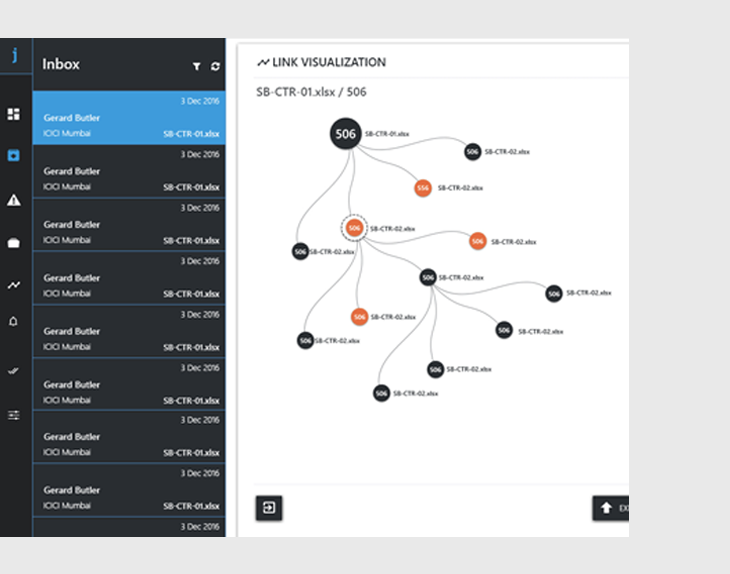

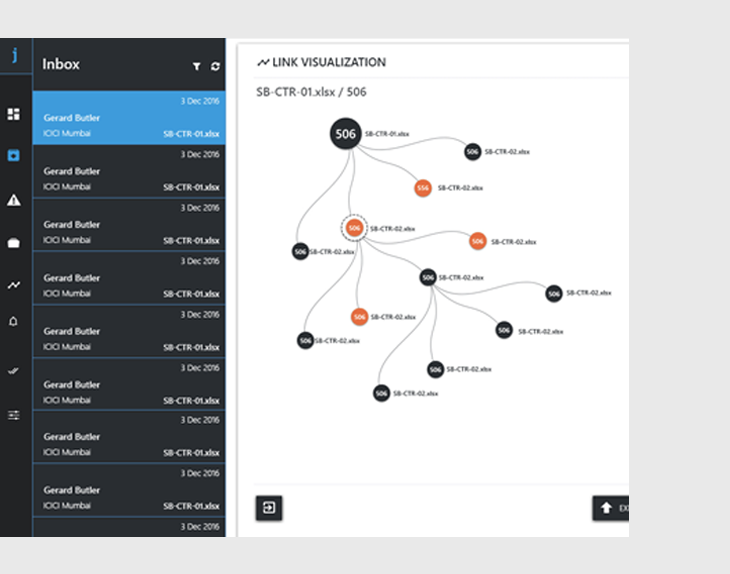

Link Analysis

Analysts at FICs can search for transactions within the system and link analysis the cash flow between multiple persons and accounts for investigative process. Link analysis is based on pattern recognition and smart transactional modeling of gross cash flow.

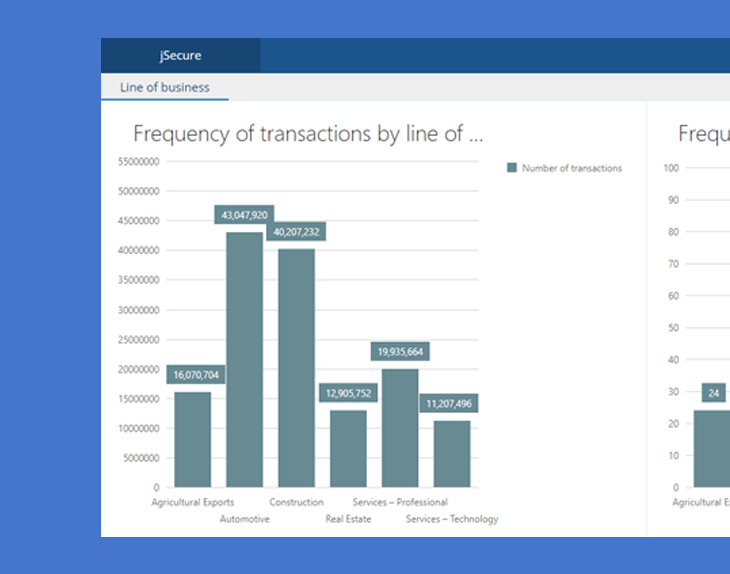

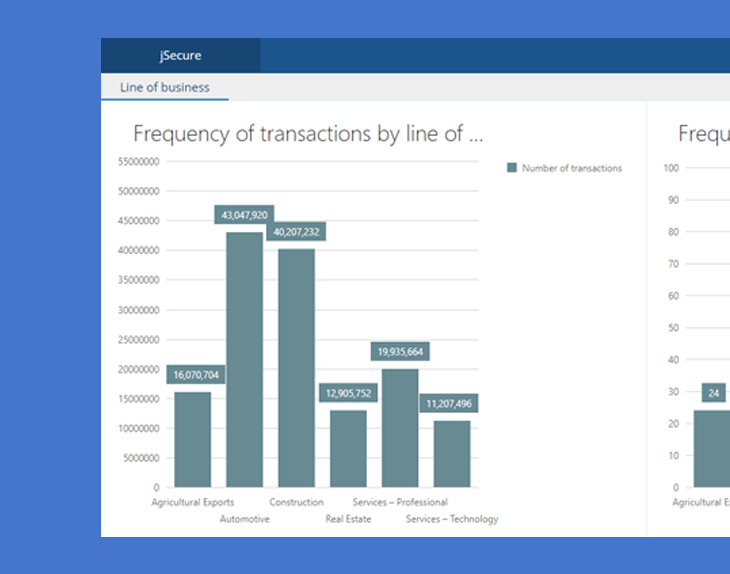

Statistical Reporting

Platform provides extensive reporting on activities in the system and business intelligence based on transactional data. Report types include employee logs, Financial Institute performance, Document statistics and preconfigured national transactional reporting

Behaviour Detection

Rule based transactional modelling to identify customer behaviour and classification. A custom scoring system provides analysts with critical information on various user characters

Explore More Projects from us

These are just a few examples of the technology projects we specialize in across the web, cloud, and mobile verticals.Contact us to explore how we can assist you with your specific technology needs.